Thursday, April 30, 2009

Fib works

Another chart a few days old that support my thoughts that at or around May 13th will mark a turning point in the market.

seeing potential @ 862ish

looking to test the long side

Wednesday, April 29, 2009

Looking to buy a dip down around the rising trendline

That was a nice ride higher though not breaking out and carrying on as I hoped. Was stopped out on the late dip @ 868. Now looking for a chance to get long again near that rising trend line in the 866ish range for another drift higher come morning. I'm still with a long sided bias up into my target area at 940ish.

EDIT: not touching this at 866... I'll wait for 860ish within a day or 2 to get long again.

EDIT: adding a sketched chart of the symmetry I expect will unfold which highlights the rounded turn higher as we proceed. This suggest a possible low of 860 at some point tonight or tomorrow.

EDIT: not touching this at 866... I'll wait for 860ish within a day or 2 to get long again.

EDIT: adding a sketched chart of the symmetry I expect will unfold which highlights the rounded turn higher as we proceed. This suggest a possible low of 860 at some point tonight or tomorrow.

Tuesday, April 28, 2009

Visualization of symmetry, scale, angles and time frames

sketching in the action

looking to buy on any dip tonight

I'm looking to buy on a dip around 848 tonight on Globex but I shouldn't fuss over 2 /ES points. This at least gives me time to watch and think. I expect by tomorrow morning we drift up towards the top of the pattern and break out to the upside on the GDP report regardless of how Bearish it might be.

Stopped out but going long again from 843

Monday, April 27, 2009

going long again for a move back up to the top

Nice pop higher

Taking 14 points off the table and stepping aside for a minute.. seems to early to try to blow through the highs time wise.

If I had to guess the thing that will get us through the highs will be a surprise GDP number tomorrow, or maybe short covering on the release of a bad GDP number.. kinda the opposite of buy the rumor sell the news. If we correct half of this pop sometime this afternoon I may go long again looking for a close right at the highs as imagined in the below chart...

If I had to guess the thing that will get us through the highs will be a surprise GDP number tomorrow, or maybe short covering on the release of a bad GDP number.. kinda the opposite of buy the rumor sell the news. If we correct half of this pop sometime this afternoon I may go long again looking for a close right at the highs as imagined in the below chart...

Sunday, April 26, 2009

Looking to catch a long trade from 854ish tonight

Proper orientation via basic techincals

My orientation remains long sided based on various tried and true basic weekly technical indicators. I have and will flip short on the shorter time periods and only enter long positions cautiously given these uncertain times. My target remains a slight breach of the January highs. Using time and price fibs I'm leaning towards a mid May peak around 940-950 range. This is an area where the 200 day moving average, RSI target signal is completed and cycles will begin pressuring the price action.

Friday, April 24, 2009

Marching onward and upward

Although I missed getting long from the Globex dip low of 842 overnight, which I had called for. I did get filled long from 848 and covered at the close of trading today. I don't want to get caught long during weekend lock up in the event of a sudden news item rocking the markets. My expectation is that we will open very strong Monday and hope to get a chance to re-enter long on any dip during Sunday night's Globex session. I'm looking for a measured move up away from the midway flag to 920ish in a day or 2 of trading followed by retest of the 880ish level. I'd love to see many days of indecision such that the last burst higher to 947ish will get caught glaringly divereged from it's underling RSI presenting the first fantastic shorting opportunity.

Thursday, April 23, 2009

I expect the flag formation to resolve to the upside

covered and out at 844 nuetral for the moment

Woke up and saw a nice rise in /ES and saw FTSE starting to look shakey after an initial pop and decided to cover for the moment.

Wednesday, April 22, 2009

globex target for the moment

Tuesday, April 21, 2009

Back to the McCellan chart.

Hopeful that the retrace has faded

I'm hopeful that the retrace back to 848 has stalled. The 848 represents both the 50% fib area as well as an area where the shorter term RSI's kiss the 70 level. I'm expecting we roll back over now and this time test that rounded 800 level. Hoping that it holds and we drift our way back up to the highs and beyond, all within a larger Bear market.

out at 841 looking for it to roll over right in here

Monday, April 20, 2009

Goal line defense of the IYG

looking for a drift higher

covered my shorts at 834 for 22pts and went long again small, looking for a drift higher in the night/early morning session to the 846-850 area and hoping for a chance to flip over short back down to the 820ish area. My view is that we will press higher into the 940ish range if they are able to halt the post opex selling after a few days of testing the lows. I'm not bullish at all but feel the short covering illiquid conidition will conitnue to frighten bears away for a bit longer

short again target 820ies

Sunday, April 19, 2009

potential short trigger

Something worth keeping an eye on

Over on TF there is a discussion going on about the McClellan summation index but the thing that caught my eye was the McClellan oscillator, the way it behaves in counter tread rallies. The pattern seems to be like a coil that builds and ends with one last thrust higher marking the beginning of the next major leg down. If the current situation plays out the same way then the reversal day should come very soon.

Saturday, April 18, 2009

Thought on the bearish put/call ratios

I'm hearing a lot of talk about how bearish the $cpce put/call ratio is recently. I can't help but wonder how much of the drop off in put buying is related to the advent of 3x ETF's

An example would be FAZ, late last year it traded maybe 3million shares a day. Friday's volume ramped over 6000% to 230 million shares traded. Is it possible that that massive volume spike in FAZ BGZ etc is actually bullish short term ?

An example would be FAZ, late last year it traded maybe 3million shares a day. Friday's volume ramped over 6000% to 230 million shares traded. Is it possible that that massive volume spike in FAZ BGZ etc is actually bullish short term ?

another look at fibs, scale and waves

Another look at the chart below reveals interesting relationships developing in the "bottoming action" The beauty of this scenario is that if it were to come true most bulls would be fully loaded while most shorts would be wiped out. The next leg down from the area of 200 day moving average should be sharp and nasty and not pause until what looks like a right shoulder of a major head and shoulders bottom presents itself. I would expect that pattern to fuel more buying and short covering before moving on to deep fresh lows.

All in keeping with the thought that the market wants to cause as much damage as possible in all directions.

All in keeping with the thought that the market wants to cause as much damage as possible in all directions.

Friday, April 17, 2009

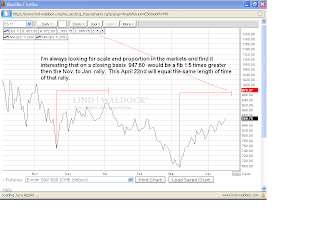

scale, proportion, fibs and symmetry

Thursday, April 16, 2009

/ES sketching

The chart below reveals the potential domino effect of multiple technical signals getting tripped. First the divereged bearish RSI suggest the low (blue dashed line) should get broken by at least one tick. However to get there we must fall out of a rising wedge pattern which is an even bigger bearish signal.

I'm keeping this scenario in the back of my mind as we continue to press higher. I often times sketch "what if" situations, stepping back, looking for symmetry and balance, pushing and dragging daily bars around until things look proportional. This is the best fit I can find assuming a worse case scenario where a massive short squeeze in an illiquid market rockets us up into the 200 mva in just a few days.. it's what kept me from going short today. The intra day RSI flashed a sell signal but on a daily basis, both 9 and 14 day RSI simply looks over bought with no signs of weakening. On the weekly basis the bullish diverged RSI still suggest 943ish should get bested.

I'm keeping this scenario in the back of my mind as we continue to press higher. I often times sketch "what if" situations, stepping back, looking for symmetry and balance, pushing and dragging daily bars around until things look proportional. This is the best fit I can find assuming a worse case scenario where a massive short squeeze in an illiquid market rockets us up into the 200 mva in just a few days.. it's what kept me from going short today. The intra day RSI flashed a sell signal but on a daily basis, both 9 and 14 day RSI simply looks over bought with no signs of weakening. On the weekly basis the bullish diverged RSI still suggest 943ish should get bested.

Bearish divergence in the /ES rsi

Wednesday, April 15, 2009

some interesting charts

I'm seeing bullish chart patterns in a lot of sectors. IYG looks to have formed a run away gap which implies an explosive move higher is on deck. Also the transports are pressed up tight against resistance on the verge of a break out. Base metals, ags. (MOO) etc. showing some sweet looking charts every where. /ES never got down to my 823ish and I covered and flipped long small when a bullish divereged RSI signal flashed on the 60min. bars. I'm holding long into the Globex session and hopefully wont get stopped out.

Tuesday, April 14, 2009

some nice symmetry patterns playing out

Monday, April 13, 2009

short term short down to 823ish

Sunday, April 12, 2009

Saturday, April 11, 2009

AA telling us something ?

Friday, April 10, 2009

Market objective coming quickly

The IYG chart came down on washout volume and hit the lows with a glaring bullish diverged RSI reading. The bounce up came on ever increasing volume and reached it's RSI signal objective. Now a head and shoulders bottom pattern has emerged with confirming heavy volume on the break of the neck line. Momentum continues to press higher and the combo of covering shorts, government manipulation, cooked bank earnings and dumb money coming off the sidelines will see this pattern reach it's objective at 51ish which falls at the 200 day mva area. That is the point where I will get short again.

Wednesday, April 8, 2009

Looking for an area to get short term long

Saturday, April 4, 2009

Corrected weekly RSI signal on SPX

Back in November I jumped the gun and expected a snap back rally back to the RSI objective area based on the signal that was flashing at that time. I wasn't paying attention enough to the cyclical wave patterns in the market at the time and there for didn't give the situation enough time to evolve. Looking back at things I'm now going to trade based on the idea that the true signal didn't complete until late February, which now calls for a minimum objective of 950ish. That also will be an area where the 200mva will come down and offer substantial resistance to this counter trend rally.

I'll be looking for a spot to get long the market in a small way.

I'll be looking for a spot to get long the market in a small way.

Wednesday, April 1, 2009

Head and shoulders building

I remain ever hopeful that we are building a classic head and shoulders top on the /ES and expect to see price roll over and rest right on neck line support right into the unemployment numbers, which I hope will blow a hole through the neck line and send us on our way at least to the .618 fib area around 720ish.

Subscribe to:

Comments (Atom)