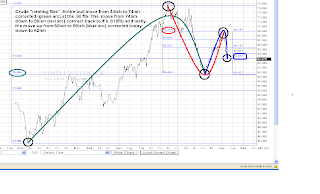

I'm always keeping my eye out for Elliott type wave relationships as often times they help mark shorter term turning points. There is always much debate about the correct primary wave count but sometimes wave segments seem to come in focus out of the blue and when I see them I latch on to them. In the chart below I highlight the battle that occurred up at the June highs, looking back on it that was one hell of a battle that was waged and I now believe it marked the ending of the bounce off the March lows. If this is in fact true then a wave count can be fitted which clearly defines wave 1 as labeled in the chart below. Wave 2 if labeled as a running flat shows very interesting wave price relationships between waves a, b and c, all of which ends with a brutal rally up to 929ish, characteristic of c waves is the steepness and the extreme levels reached on the RSI, (highest level since the March bounce began) Finally running flats tend to suggest that the next leg, (wave 3) should be massive and violent.

Another thing that might help exasperate the next leg down in stocks is if the crude oil market decides to head down into those low 50ies. The chart below argues that the turning point in crude might be close at hand...