Thursday, December 31, 2009

SPX weekly with RSI

wow what a way to end the weekly close.. that last minute mini dive bomber action strengthened the sell signal on the weekly charts and now the 200 day moving avg (40wma on the weekly) is now in the cross hairs...

Wednesday, December 30, 2009

IYR head and shoulders objective hit..

Wednesday, December 23, 2009

Weekly $SPX

If we can get $SPX to come back to around 1105-1110ish that would take some of the edge off of RSI's rise and still allow for a strong bearish read of the charts. In the chart below I copied and pulled up the RSI and tweaked it to reflect how it would look if we can get a lower close tomorrow to finish off the weekly bar...

Saturday, December 19, 2009

Friday, December 18, 2009

Sell signal intensifies

Tuesday, December 15, 2009

DUG vs. $USDUPX.X (U.S. Dollar index)

Friday, December 11, 2009

Weekly divergence still intact..

Friday, December 4, 2009

SPX vs RSI overlaid with RSI

expanding triangle for a finish

Tuesday, December 1, 2009

XOM sell signal

Saturday, November 28, 2009

SPX RSI weekly signal

Saturday, November 14, 2009

$DJCOMP weekly target

Looking at the weekly chart of the Dow composite index things look lined up to finally test the 200 day moving average which is at the apprx area of the minimum downside projection of the weekly RSI sell signal that is now flashing. If this price objective is met it will cause another longer term (weekly) topping chart pattern to emerge the likes of which is still yet to be seen...

Thursday, November 12, 2009

RSI target hit..

well the RSI sell target has been hit and I'd expect stocks may try to move back up to test the highs again however the divergence that is opening up between the high yield ramp job and utilities suggest high yield bonds have gotten ahead of themselves and should spook the market some as it comes back inline, therefore I suspect the selling in equities isn't over yet...

Wednesday, November 11, 2009

$SPX intra day channel targets

Thursday, November 5, 2009

flag consolidation in IYG

Tuesday, November 3, 2009

$SPX vs XOM

I'm keeping a close eye on XOM as a clue to where $SPX may be heading longer term.

Notice how XOM sold off less then the markets since the 2007 top yet since the bounce off the lows XOM has lagged and seems to be trading within a longer term consolation and in fact price seems to be struggling to get above a very long term uptrend line. I think I can apply a Elliott wave count to XOM that suggests price is about to fail out this level and take us down in a large C wave affair...

Notice how XOM sold off less then the markets since the 2007 top yet since the bounce off the lows XOM has lagged and seems to be trading within a longer term consolation and in fact price seems to be struggling to get above a very long term uptrend line. I think I can apply a Elliott wave count to XOM that suggests price is about to fail out this level and take us down in a large C wave affair...

IYM technicals

Monday, November 2, 2009

Dollar vs. SPY

The next shoe to drop...

Just looking at C from a technical stand point let alone the fundies and I think I can see where one of the next shoes to drop will come from. On the daily when you see a test of the lows coming in this kind of pattern and then look a little deeper and see the one minute intra day bar chart with OBV and something about to snap...

Friday, October 30, 2009

SPY weekly

The weekly chart stepped up and over ruled the whip action in the daily chart and now has a minimum price objective of 101.98 but I suspect with the speed of the decline and increasing volume accompanying it that the gravitational pull of the 200 day moving average has taken over and demands a revisit of price...

Thursday, October 29, 2009

SPY thoughts..

Wednesday, October 28, 2009

$SPX techincals

I still believe the failed head and shoulders break out which sparked the last few months of rally needs to be revisited partly because you would expect a huge surge of volume on that kind of move which did not occur. Also the slower 14 day RSI has flashed a sell signal which is confirmed by the diverged OBV and I noticed that of the 4 recent roll over dips the previous 3 occurred with negligible volume and this last one was accompanied with 6 straight days of heavy volume. Lets not forget price has pulled to record distance from the 200 day moving average which is set to exert it's gravitational pull on the market....

Tuesday, October 27, 2009

HD head and shoulders

Monday, October 26, 2009

Looking for a lower close on the weekly $SPX

Sunday, October 25, 2009

Friday, October 23, 2009

it's still early but..

Wednesday, October 21, 2009

SPY action..

Tuesday, October 20, 2009

gold and the dollar...

Monday, October 19, 2009

RKH RSI

Saturday, October 17, 2009

Elliott wave thoughts....

I'm considering the idea that wave 3 and 5 both threw over the channel based on a combination of fed pumping, corruption in analysts buy recommendations leading to the tech wreck, more fed pumping after 9/11 with more rating agency corruption leading to the housing crash and now a finale desperate fed pump that has only brought us back up to test the upper channel line. (labeled wave B) which suggests a collapse on deck (wave C) which takes us down through the lower channel line by late summer or early fall of 2010....

Friday, October 16, 2009

Wednesday, October 14, 2009

Monday, October 12, 2009

SPY looking weak..

Sunday, October 11, 2009

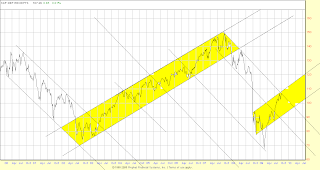

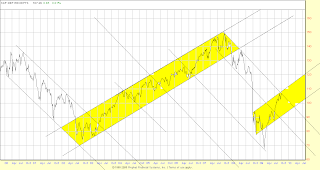

potential SPY channels...

Friday, October 9, 2009

geometric visuals..

stepping back and searching for some geometric proportion derived off parallels tied to the major trend channels reveals one possibility that we are pressing against an upper channel in a bull trend and may need to test the low end of the range. I'm not a bull but perhaps at the least we are do for a correction..

Thursday, October 8, 2009

SPY OBV

Dollar looks like it's about to explode north...

Looking at the dollar through UUP I'm seeing the potential for one more intra day low followed by a higher close that would mark the intermediate low for the dollar..

ALso I'm seeing the potential for a substantial move lower in the energy sector through OIH which reveals a divergent RSI on the break out higher that occurred on negligible volume, not what you would expect on a break out...

ALso I'm seeing the potential for a substantial move lower in the energy sector through OIH which reveals a divergent RSI on the break out higher that occurred on negligible volume, not what you would expect on a break out...

Tuesday, October 6, 2009

SPY broken long term trend line..

Sunday, October 4, 2009

Bonds and stocks dislocation...

Subscribe to:

Comments (Atom)