Monday, March 8, 2010

Tuesday, March 2, 2010

I'm going with the brief dollar weakness train of thought..

Last night and today's trading in the /ES has me throwing in the towel and looking for a move up to near 1200. With all the talk about massive euro shorts along with the daily rsi on the /DX chart diverging and signaling a dip in the dollar just ahead not to mention the metals and energies took off running today in anticipation, I'm long small /ES looking for nominal new highs on a blow off type move..

Friday, February 26, 2010

If the dollar flushes...

If the dollar flushes then I would expect the stock market might make a run for the recent highs. The RSI divergence on the daily /DX suggests there is a good chance of that happening. However with the weekly sell signal on the /ES still not completed I'm maintaining my net short positions over the weekend...

Tuesday, February 23, 2010

Monday, February 22, 2010

The Bear flag may appear to be fading..

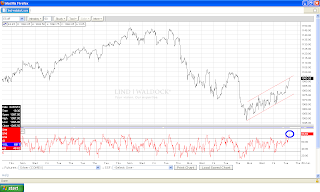

RSI signal on the 120 min. bars...

Sunday, February 21, 2010

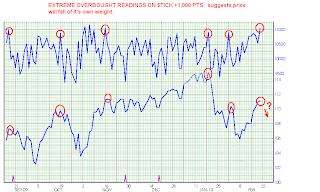

Both daily and intra-day $tick readings at extreme extremes..

Friday, February 19, 2010

still not convinced..

I struggled with the idea of covering all afternoon but didn't because I can still see price inside a defined channel with a RSI divergent, though fading, on the 60 minute chart. The 120 minute chart is still a firm sell signal. Also often is the case that price hesitates for 1 or 2 days before reacting to events, this often confuses and gives a false sense of calm specially near C wave terminus...

Thursday, February 18, 2010

ES/ rsi divergence at the top of the channel

Wednesday, February 17, 2010

Tuesday, February 16, 2010

smelled like C wave panic covering today...

Saturday, February 13, 2010

flags and consolidations....

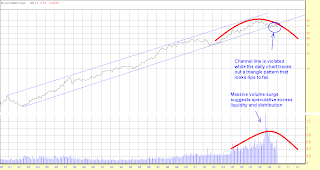

For the most part flags, pendants and consolidations tend to tilt opposite of the primary trend. With Pavlov's dog like behavior folks are pouring into what they believe is a correction in a bull market, confirmed by what has been the case since the March bottom. However I'm seeing chart after chart of bearish flag setups suggesting to me that we about to dump hard...

Friday, February 12, 2010

Thursday, February 11, 2010

More on the Silver Cross...

Wednesday, February 10, 2010

Silver Cross

sketching in the action..

RSI on the daily ES plunged pretty deep on the first leg down and now I can visualize the ES drifting up into the 1075ish area the next few days before rolling over and making a stab down at the 200 day moving average. If so, it looks to me like daily RSI may flash a bullish divergence at that point, and so I'll be looking for one of those days where we trade down and trace out a bowl type affair, closing up near the highs at the end of the day. The weekly RSI signal at that point has reached it's minimum objective and with a bullish daily divergence I may have to flip long but we'll see how things look while thrashing around down there at the 200 day moving average...

Tuesday, February 9, 2010

potential 3 of 3 action developing on the ES

Saturday, January 30, 2010

$SPX target

Friday, January 29, 2010

$SPX look and feel...

Tuesday, January 26, 2010

ASA vs. UUP

Looking at ASA (proxy for an international precious metals type of index) against UUP, I'm seeing a topping head and shoulders pattern while at the same time it's breaking below a fairly dependable long term rising trend line. I think ASA is telegraphing expectations for a period of dollar strength...

Friday, January 22, 2010

My plan is to let XOM tell me where the bottom lies

What with RSI weekly basis on $SPX yet to build to the crescendo stage and XOM losing it's grip hold of a very important long term trendline, I'll not think about covering anything until XOM reaches it's first measured move objective which lies down around 55ish and hopefully 47ish. The 55 zone on XOM suggests another 16+% decline or 950ish SPX while 47 zone suggests almost 30% from this week's close, if the $SPX can roughly correlate the action in XOM then the lower target comes in at the 800 level...

Tuesday, January 19, 2010

Long term transports and CSX

Friday, January 15, 2010

What XOM is telling me...

Friday, January 8, 2010

Wednesday, January 6, 2010

calm before the storm?

Back in Aug 08 the dollar launched higher while $SPX went into an upward skewed holding pattern waiting to see if the dollar would come back. It didn't, and soon there after the $SPX dumped. Looking at the overlay of the dollar and SPX it appears the same potential situation is at hand with the first thrust up in the dollar being doubted by investors. Bad news overseas could ignite phase 2 of the dollar rally and another dump in stocks.

The 1st Chart highlights the current market with Aug. 08.

I removed all the chaos from the one chart to show how we've come full circle and I believe are about to embark on the next leg down....

The 1st Chart highlights the current market with Aug. 08.

I removed all the chaos from the one chart to show how we've come full circle and I believe are about to embark on the next leg down....

I'm seeing RSI divergences on the short medium and long term

Subscribe to:

Comments (Atom)